Climate Transition Plans: How EU standards can help companies to focus on the right data

Climate change is a critical issue that no company can afford to ignore. The Paris Agreement and the Intergovernmental Panel on Climate Change are clear: decisive action is needed to reduce greenhouse gas emissions and ensure climate-resilient economies. The European Green Deal outlines plans for such decisive action with the objective to make Europe a carbon-neutral continent by 2050.

This transition will bring about risks and opportunities of unprecedented scale and speed in all sectors of the economy. As the President of the European Central Bank Christine Lagarde puts it “we need to transform our economies as structural changes speed up around us”.

Further Information

It is becoming essential for companies’ success – and survival – to align their business models to a net-zero future. To be able to do it, companies’ need to develop comprehensive climate transition plans that address core aspects of their business strategy. And companies increasingly do so as Paul Polman, former CEO of Unilever pointed out: “The proliferation of corporate decarbonization plans and sustainability initiatives has now reached an impressive crescendo.” But at the same time he adds: “Regrettably, the same can also be said of greenwashing (…) So far, corporate ESG data has been lacking in quality, consistency, and comparability, which makes it difficult for asset managers to determine where to direct investments.”

As the EU Sustainable Finance Strategy aims at channelling an additional 500 billion EUR of private investments each year into sustainable business activities, companies need to focus on and report the right data to be able to harness this opportunity. To help them to do so, the EU is replacing its legislation on ‘non-financial reporting’ with a new Corporate Sustainability Reporting Directive (CSRD), which will be supported by reporting standards. Companies will get clarity from these standards on how to report on their climate transition towards a net-zero economy, how to conduct scenario analysis, and on the key metrics to assess risks, opportunities, performance and impacts.

This article addresses two questions:

- What information is critical for companies to consider in the context of their climate transition plans?

- What are the key issues that the EU climate reporting standard needs to address to help companies in this regard?

Critical information for climate transition

The EU Sustainable Finance Disclosure Regulation (SFDR) and the EU taxonomy already outline the main information investors will need to disclose and gather from companies, as of January 2022. (More details about this in our previous article). If investors have to provide this information, it follows that they will ask companies to provide it too.

This information falls in two main categories, both addressing a company’s business model: climate change transition plans, and the analysis of climate risks and opportunities. The current legislation – the Non-Financial Reporting Directive – provides some guidance to companies, but leaves many details unaddressed. Below, we explain what information and data count as key for meaningful reporting.

1. Climate change transition plan

Climate change transition plans are a shorthand for companies’ strategies to contribute to and thrive in a transition towards a net-zero economy. Net-zero refers to the goal of achieving no net emissions of greenhouse gases. The European Green Deal – the European Commission’s flagship initiative for economic growth and transformation – has set this goal for 2050. The plan should set out the pathway of how ‘net zero’ will be achieved and contributed to by the company – with review points along the way, to ensure it meets its objective.

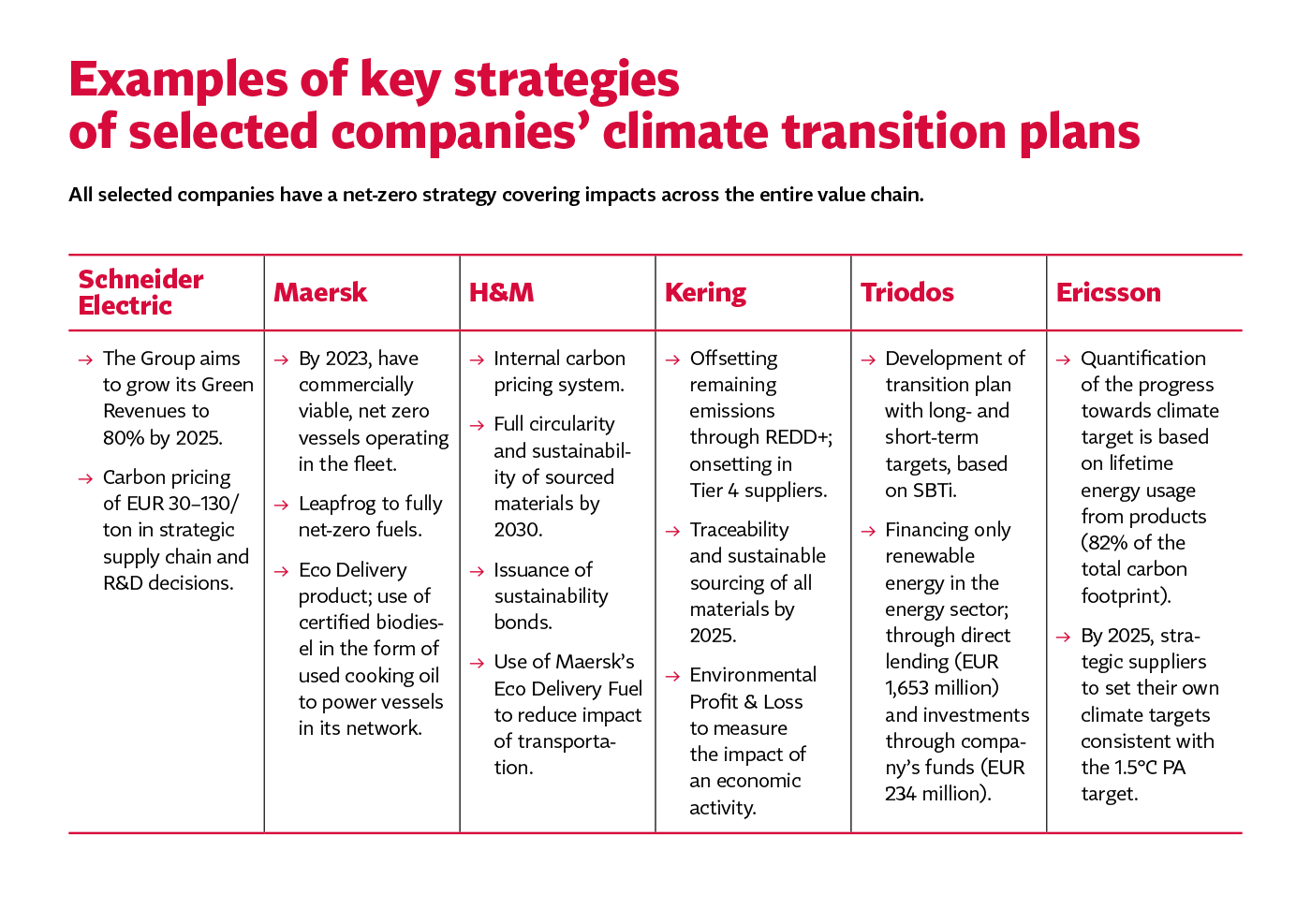

The company’s contribution consists of two parts. First, companies will need to eliminate their own direct and indirect emissions, and decommission harmful activities. Second, companies can develop business activities that enable the net-zero transformation, for example in the area of renewable energy, ecological transportation, construction industry, IT solutions, and – of course – finance.

The main elements that companies, investors, insurers and banks need to consider in their transition plan, are the following:

- Carbon emission reduction target, covering the company’s overall emissions (financial companies should focus on the carbon footprint of their investments), including:

- milestones for the short (2025/2030), medium (2035/2040) and long-term (2050)

- alignment of the company’s net-zero ambition with the 1.5°C objective, and information on the source and details of the scenario on which the plan is based

- Action plans corresponding to short, medium, and long-term horizons, including site-level transition plans for the main sources of emissions, and constraints identified in the implementation

- Target for investment in or development of products and services substantially contributing to climate change mitigation or adaptation and/or EU taxonomy exposure targets

- Capital allocation, including capex plans on:

- New sustainable / taxonomy-eligible activities

- Retrofit/decommission harmful activities

- Metrics (financial companies need to provide corresponding indicators related to impacts of their assets related to the value of the investment)

- Greenhouse Gas Emissions and Intensity: Scope 1 (direct), 2 (indirect from energy); 3 (indirect that occur in value chain)

- Energy: Consumption and/or production from renewables; overall consumption and efficiency (in high-consumption sectors)

- Share of turnover and CAPEX associated with Taxonomy-aligned activities substantially contributing to climate change mitigation and adaptation

To be able to develop a climate transition plan, companies need to carry out two assessments.

First, the plan needs to be based on an analysis of the entire value chain to identify where the main impacts, and sources of risks and opportunities are. Not only is this increasingly expected by providers of financial capital and by regulation, it is also important to understand the resilience of business models and for setting the right focus.

In this sense, Lene Bjørn Serpa, Head of Corporate Sustainability at Maersk (global leader in container logistics) says: “Our decarbonisation strategy focuses on where we can make the largest global impact and support our customers’ efforts to decarbonise their supply chains”. Furthermore, she adds that they “have set a target to have net zero emissions from ocean operations by 2050 and are taking steps to expand targets and reporting to include full value chain emissions and align with science-based targets.”

Second, companies need to carry out an analysis of climate-related risks and opportunities. This provides the context in which they can consider and justify the investments in the transition. The framework for such reporting is provided by the Task Force on Climate Related Financial Disclosures (TCFD), whose recommendations were globally endorsed and provide a basis for the development of European standards.

2. Climate related risks, opportunities and governance

Understanding climate-related risks and opportunities is essential for a company’s ability to define a meaningful strategy. It allows calculating the costs of inaction, prioritise the right investments, and attract capital in favour of their low-carbon transition.

According to the CDP’s study, 200 of the world’s largest listed companies forecasted that climate change could cost them a combined total of almost $1 trillion, with much of the pain due in the next five years. On the other hand, the value of low carbon opportunities such as through higher demand for electric vehicles and green infrastructure identified by 882 European companies has reached €1.22 trillion, more than six times higher than the investment cost of €192 billion, as shown by another CDP study from 2020.

Understanding the opportunities and the risks of missed opportunities is important for all sectors. However, especially companies in high-impact sectors need a comprehensive analysis to understand what lies ahead of them.

The key factors companies need to focus on in their analysis and disclosure are the following:

- Principal risks for short, medium and long-term horizons, differentiated between:

- Transition risks facing the company’s business model in a 1.5°C scenario, taking into account the EU net-zero strategy and milestones, and the company’s targets. This allows companies to understand whether their own targets are ambitious enough and aligned with international objectives, as well as the costs of inaction.

- Physical risks, such as extreme weather events and environmental changes threatening the company’s assets or value chains. This analysis should take into account various other scenarios, beyond 1.5°C.

- Opportunities connected to climate change mitigation and adaptation needs, that is how the company’s business strategy, products and services can harness the transition. The Business Commission for Sustainable Development reported that meeting the UN Sustainable Development Goals (SDGs), would create market opportunities of EUR 10 trillion per year by 2030.

- Integration of the assessment of climate risks and opportunities in the governance of the company, which is critical for the company’s ability to consider the need for major changes to its business model and strategy. It represents an important proxy reflecting the company’s seriousness and maturity in terms of managing risks and opportunities, and integrating them in the company’s overall strategy. Details on how to advance governance-related disclosures can be found in our previous article ‘What needs to be reported on Governance (of ESG)’.

The analysis should be supported by quantitative financial estimations for the issues that can be predicted, such as the costs of carbon emissions or emission allowances, or the growth of the market for sustainable products or services.

The need for a complex analysis is particularly high for banks and institutional investors. Energy companies, likewise, need to have absolute clarity on the implications of public policies for their business model, however such an analysis is fairly straightforward. Companies that do not have high-impact, but are dependent on supply chains in vulnerable regions, should use tools for the geomodelling of physical risks. Companies that do not face any obvious risks, need to at least give a thought to the rising prices of energy, and to the opportunities concerning products and services that their sector may provide to enable climate change mitigation. A good starting point is the 2021 edition of SASB’s Climate Risk Technical Bulletin, showing how climate risks and opportunities manifest in unique ways across 77 industries. Two further frameworks which some companies are using to assist them are the Science-based Targets initiative and the Transition Pathways Initiative.

Key issues that the EU climate reporting standard needs to address

This is a pivotal moment for Europe and its companies, as we stand on the verge of transitioning to a low-carbon and resilient economy. The challenges and opportunities as well as the scope and speed of the change are unprecedented.

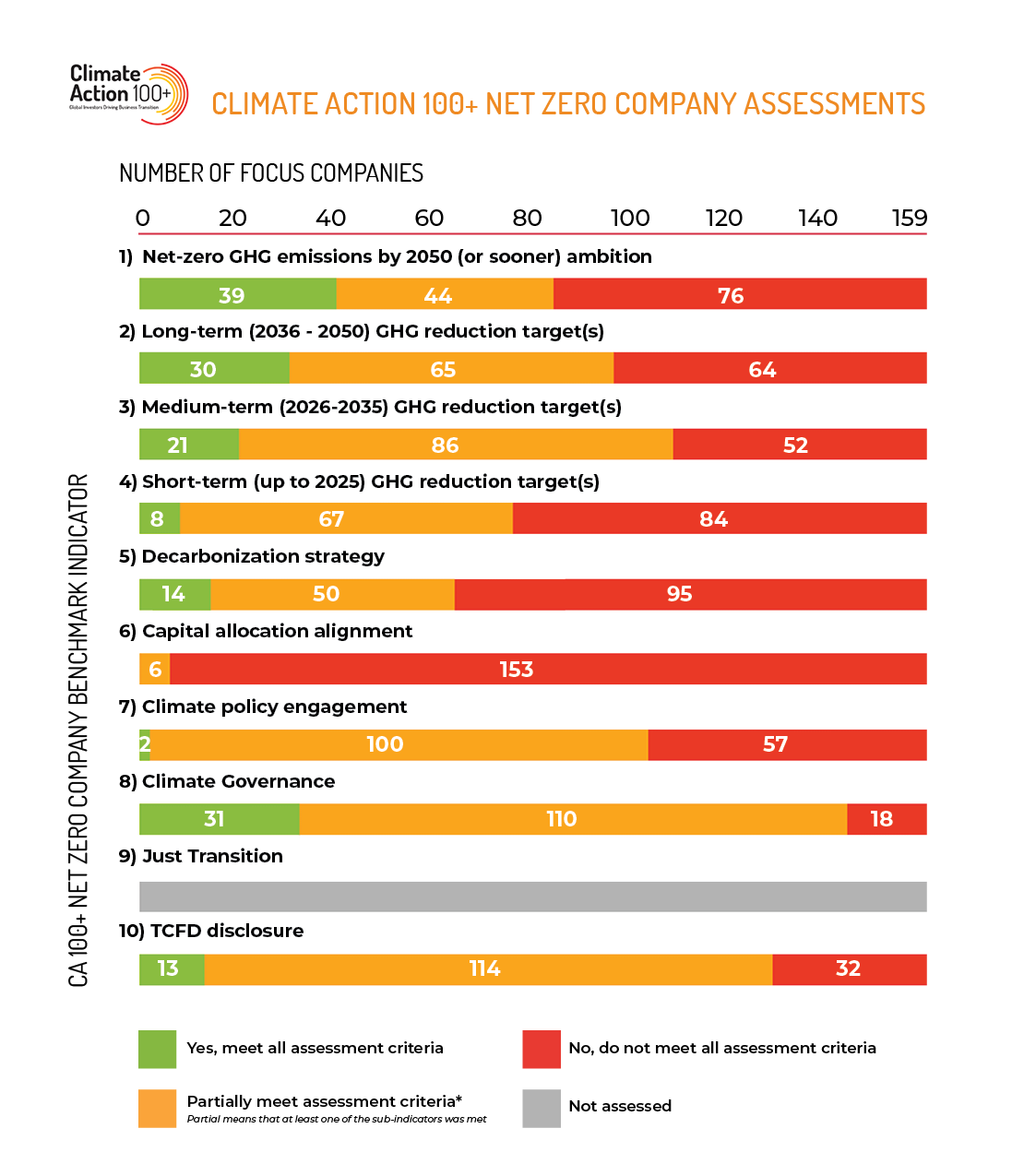

However, as found by the research of the Alliance for Corporate Transparency on 1000 company reports, companies struggle with analysing climate risks and opportunities and providing the right data about their climate transition plans. Same conclusions were reached by Climate Action 100+ companies’ assessment (consult the graph and box below for more details).

The data shows that while more than a half of the assessed companies has some level of net-zero ambition, less than 10 % met all criteria for a quantified decarbonisation strategy and not a single company was committed to aligning capital expenditure with 1.5 degrees. The study of the Alliance for Corporate Transparency on the climate reporting of 300 Southern European and CEE companies from high risk industries demonstrates similar low levels of specificity; less than 16 % of companies have a science-based target. Forward-looking information on companies’ strategic targets and progress is disclosed by less than 10% of companies for climate transition plans.

To be able to identify and report relevant and comparable data, companies will need clarity on key reporting elements, methodologies to be followed, and sectoral specifications for indicators. This is even more so important as investors and banks are realigning their strategies to support the transition to a sustainable economy, within the framework provided by the SFDR and Taxonomy criteria, which will enter into force on 1st January 2022.

Companies can consult leading international standards provided by SASB, GRI and CDP. However, the current gaps need to be covered by the sustainability reporting standards accompanying the CSRD reform (see previous article for further details on the interconnections and timeline of different pieces of legislation).

The EU standards can help companies and bring down the barriers to reporting by providing clear methodology criteria in four areas:

- Climate change transition plans. The net-zero ambition is quickly becoming a standard, but it is not clear to users and prepares alike what needs to be reported on implementation. In the first place, clarity is needed on what is meant by net zero target – including the activities and types of emissions covered by such a definition – but also on the additional information companies should disclose in this sense, including interim objectives and related timelines, and capital alignment.

- Baseline climate scenarios and tools for scenario analysis. Using scenario analysis to identify long-term risks and opportunities is extremely challenging for companies. The role of the standards should not be to merely copy from the far-reaching, yet vague requirements of existing international standards, but rather to help companies to assess the risks. What is mostly needed is clarity on which scenarios companies should use, and guidance on how to implement the analysis.

- Metrics for risks and opportunities. A further challenge faced by companies is the lack of clarity on what to disclose on risks and opportunities. EU standards can provide more specific indications for companies to follow, especially with respect to key sector-sensitive quantitative indicators.

- Sector-specific calculation methodologies of GHG intensity and Scope 3 GHG emissions (carbon footprint). As shown by the research of the Alliance for Corporate Transparency, the methodologies used by companies for more complicated indicators are highly divergent, particularly as concerns Scope 3 emissions. This is particularly problematic in light of the increasing relevance of value chain-related emissions for the climate policies of both public and private investors.

Clear EU climate reporting standards in these four areas are of critical importance to help navigate companies through their transition. And as concluded by the European Project Task Force on Non-Financial Reporting Standards under the EFRAG in its final advice to the European Commission, standards on climate change should be one of the early priorities of the future EU corporate sustainability reporting framework.

There is no doubt that we are moving towards a situation where all companies have climate transition plans, for reasons of regulation, investor demand and quite simply of good business. However, the challenge for companies – demonstrated by the research – is that current uncertainties are making it difficult for today’s corporate sustainability reporting to be sufficiently forward-looking, detailed and aligned with the Paris targets – to meet the imperatives of climate change itself. In this article, we have given some detail of what are the key components of a climate transition plan and have identified the four specific areas for European Standards to bring the necessary clarity for the future. This can help companies navigate the next stage of their transition now. There is quite literally no time to delay.

This is the fourth article by Frank Bold as part of the series of monthly briefings on sustainability reporting in 2021. The previous articles covered various topics such as reporting on governance (G of ESG) or sustainability reporting standards and their connections to SFDR and taxonomy.