Companies’ Sustainability Disclosures

Die Alliance for Corporate Transparency wurde ins Leben gerufen, um Daten und Belege für die Debatte über die Standardisierung der Nachhaltigkeitsberichterstattung von Unternehmen und die Rolle des Gesetzgebers zu liefern. Die von dem Netzwerk Frank Bold koordinierte zivilgesellschaftliche Initiative hat die bisher größte Studie zu diesem Thema durchgeführt und 1000 europäische Unternehmen daraufhin analysiert, inwieweit sie die Anforderungen der EU-Richtlinie zur nichtfinanziellen Berichterstattung umsetzen.

The research is connected with EUKI’s project on “Improving climate and sustainability corporate disclosure policies to enable sustainable finance” that started in 2019 with the objective of improving corporate disclosure of climate and sustainability risks and mitigation plans. The project aims to support the reorientation of capital flows towards sustainable investment and foster the development of transition plans by companies and investors to low-carbon business models. The poor quality and comparability of corporate disclosures hinder the efforts to scale up sustainable finance as investors do not have reliable information to inform their decisions. This leaves major financial risks stemming from sustainability challenges, especially climate change, unaccounted for in investor and corporate strategies, as well as important social and environmental impacts unaddressed.

Frank Bold hosted on February 17 a high-level event with over 200 participants, including regulators, investor and company representatives, civil society organisations, think tanks and supervisory authorities. Speakers and participants discussed the necessary changes and reforms of the legal framework. The research arrives at the same time that the EU Commission initiates the process to reform the EU Non-Financial Reporting Directive and after Executive Vice President Vadis Dombrovskis announced plans to create EU standards for corporate sustainability reporting.

The launch of the research has been covered by Reuters, AlJazeera, New York Times, Business Insider among others and included in Politico‘s Global Translations.

The event was opened by Members of the European Parliament Heidi Hautala, and Lara Wolters, and followed by panel discussions with Sebastien Godinot (WWF) Rosl Veltmeijer-Smits (Triodos), Lene Serpa (Maersk), Bastian Buck (GRI), Mirjam Wolfrum (CDP Europe), Eleni Choidas (ShareAction), Michael Zimonyi (CDSB). Richard Howitt, expert on corporate sustainability and Phil Bloomer (Business and Human Rights Resource Center) moderated the debate. The conference was closed by Alain Deckers, Head of Unit at DG FISMA (EU Commission) responsible for corporate reporting, audit and credit rating agencies. He welcomed the research and confirmed that the findings and conclusions of the project included in the Research Report are aligned with the EU Commission’s own assessment and that the NFR Directive is not currently meeting its objectives.

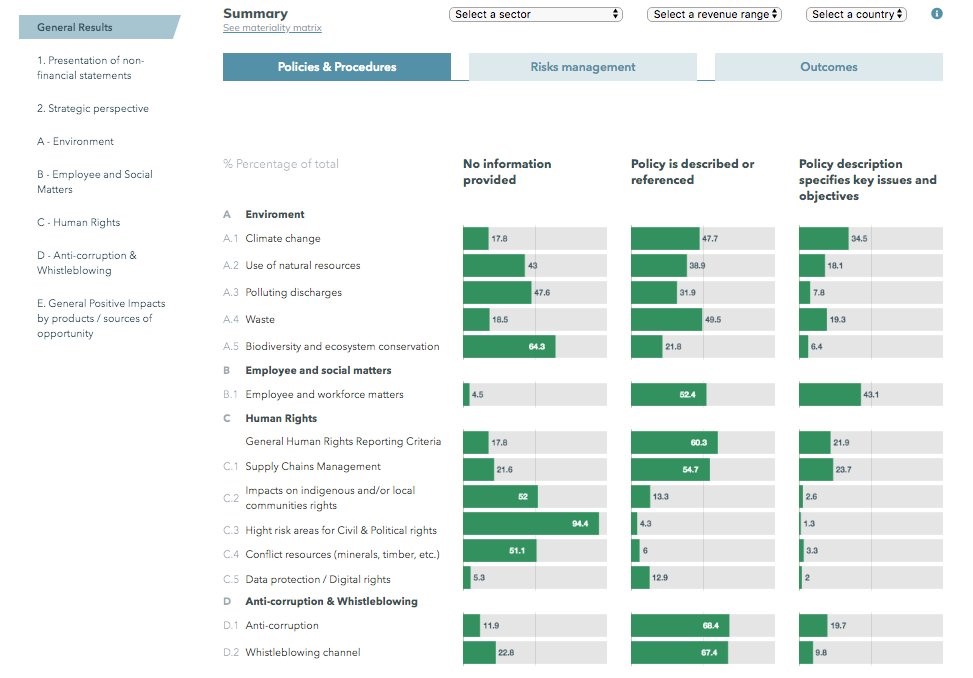

Frank Bold’s Filip Gregor, alongside Carlos Cordero, Managing Partner at Sustentia, presented the key findings of the research. Notably, the assessment of the disclosures made by 1000 companies show that:

- only 13.9% of companies report on alignment of their climate targets with the Paris agreement goals (i.e. to keep global warming well below 2 degrees Celsius). This number is higher in the Energy & Resource Extraction sector (23.5%), but still more than three quarters of the most impactful companies don’t report on their targets and plans in this context.

- Just 23.4% provide specific information that allows readers to understand the climate-related risks they are facing – out of 53.8% reporting that they recognize the existence of such risks- whilst only 6.6% clearly consider the risks with regard to the transition to a well below 2 degrees Celsius scenario. Furthermore, only 13.4% of financial companies provide details on the exposure of their portfolios to the most polluting sectors.

- Specific risks with regards to the use of natural resources are being identified by 12.5%, 9.6% for polluting discharges, 7.2% for biodiversity and ecosystem conservation, and only 6.6% for waste.

Full results available in public database: http://www.allianceforcorporatetransparency.org/database/

Reliable information on sustainability is indispensable to enable European banks and investors to factor climate, environmental and social risks in their decisions. This in turn underpins the EU’s ability to transform the economy in order to address climate change and stop environmental degradation.

The European Commission is expected to present a renewed sustainable finance strategy later this year that will build on its previous Sustainable Finance Action Plan to reorientate capital flows and mitigate financial risks facing the European economy stemming from climate change. Corporate transparency is the first level to ensure that these plans succeed.

Follow on Twitter and register to the newsletter if you wish to be informed of the news related to EUKI project “Improving climate and sustainability corporate disclosure policies to enable sustainable finance”. In 2020, the project will carry out further in-depth research and organised a series of expert workshops. Please contact kristyna.vejvodova@frankbold.org“>Kristyna Vejvdova or susanna.arus@frankbold.org“>Susanna Arus for more information.